Compliances for Nidhi Company: Legal Requirements

Nidhi companies, governed by the Companies Act, 2013, and the Nidhi Rules, 2014, are subject to specific compliance requirements to ensure their smooth operation. These companies, which primarily focus on promoting thrift and savings among their members, must adhere to strict regulations concerning their structure, operations, and financial activities. A Nidhi company must have at least 200 members within one year of incorporation and a minimum of three directors. Nidhi companies must maintain proper accounting records and file annual returns with the Ministry of Corporate Affairs (MCA), including financial statements like balance sheets, profit, and loss accounts, and cash flow statements, in compliance with the prescribed timelines. Nidhi companies are also required to undergo a statutory audit conducted by a qualified chartered accountant to ensure that their financial statements reflect an accurate picture of their operations. They can only accept deposits from their members and must ensure these deposits do not exceed 20 times their net owned funds (NOF).

10,000+

Clients Served

10,000+

Businesses Registered

10,000+

Legal Advices

Google Reviews

4.1/5 | 50+ Happy Reviews

Guaranteed Registration

Guaranteed Registration Cost Effective Rates

Cost Effective Rates 24x7 Support

24x7 Support 10K+ Businesses Registered

10K+ Businesses Registered

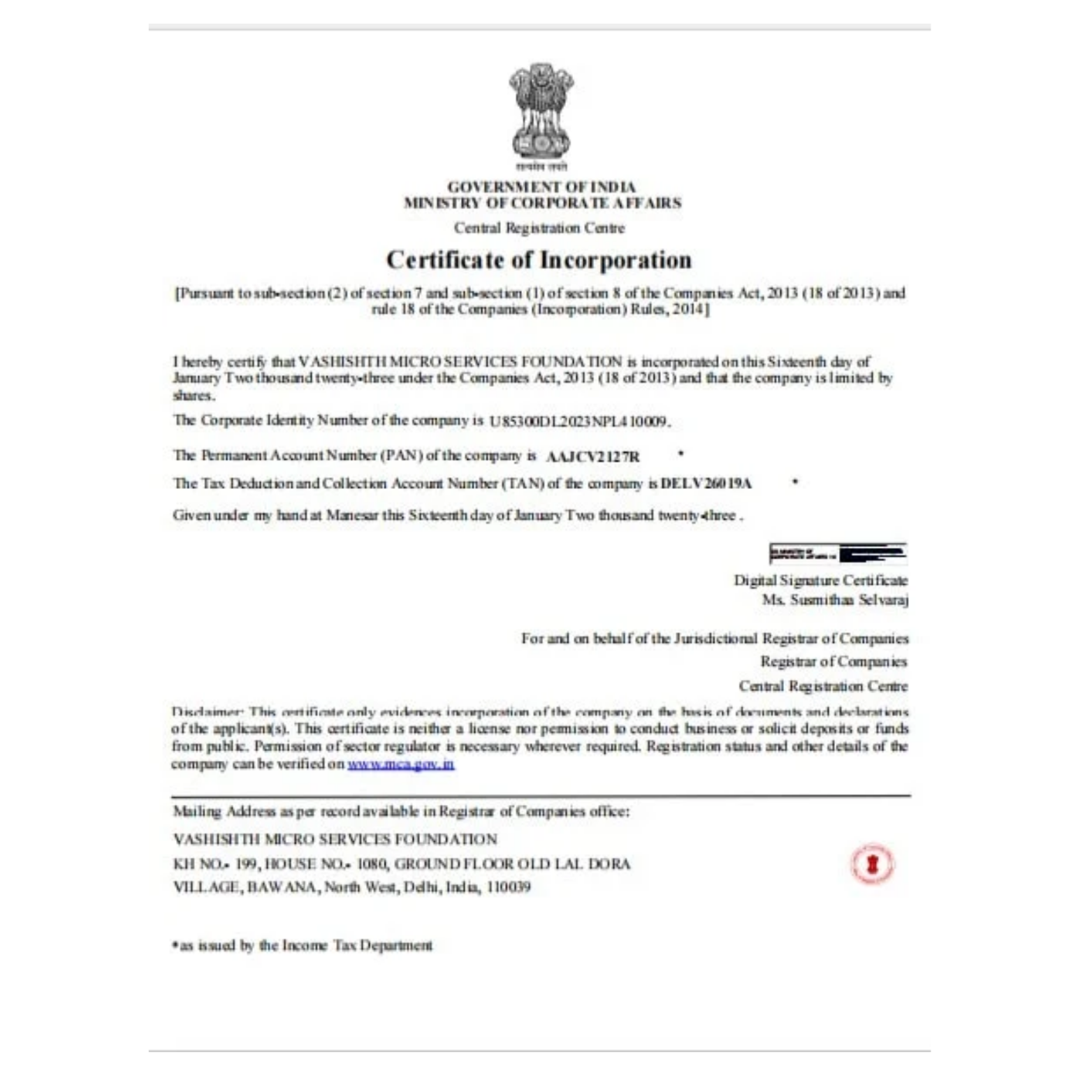

Documents & Details Required

of 2 persons

PAN, Aadhaar, Photo, Mobile, Email

PAN, Aadhaar, Photo, Mobile, Email Latest Bank Statements

Latest Bank Statements Company Name

Company Name Rent Agreement for the Company Address

Rent Agreement for the Company Address

Need Help?

Fill the Form Below