Tax Exemptions & Donor Deductions in 12A and 80G Registration for Charitable Organizations in India

12A and 80G registrations are essential for non-profit organizations in India to avail tax exemptions and enable donors to claim deductions on their contributions. Section 12A of the Income Tax Act provides tax exemption on income for charitable trusts, institutions, and non-profit organizations, ensuring that they are not taxed on the funds they receive for their charitable purposes. This registration allows these organizations to carry out activities like providing education, healthcare, and other social services without the burden of paying taxes on their income. On the other hand, Section 80G offers tax deductions to individuals and entities donating to recognized charitable organizations. This means that donors can reduce their taxable income by the amount they contribute, which not only encourages philanthropy but also benefits donors with reduced tax liabilities. Obtaining 12A and 80G registrations requires the organization to fulfill certain criteria, including demonstrating that it is genuinely engaged in charitable activities and that the donations it receives will be used exclusively for charitable purposes.

10,000+

Clients Served

10,000+

Businesses Registered

10,000+

Legal Advices

Google Reviews

4.1/5 | 50+ Happy Reviews

Guaranteed Registration

Guaranteed Registration Cost Effective Rates

Cost Effective Rates 24x7 Support

24x7 Support 10K+ Businesses Registered

10K+ Businesses Registered

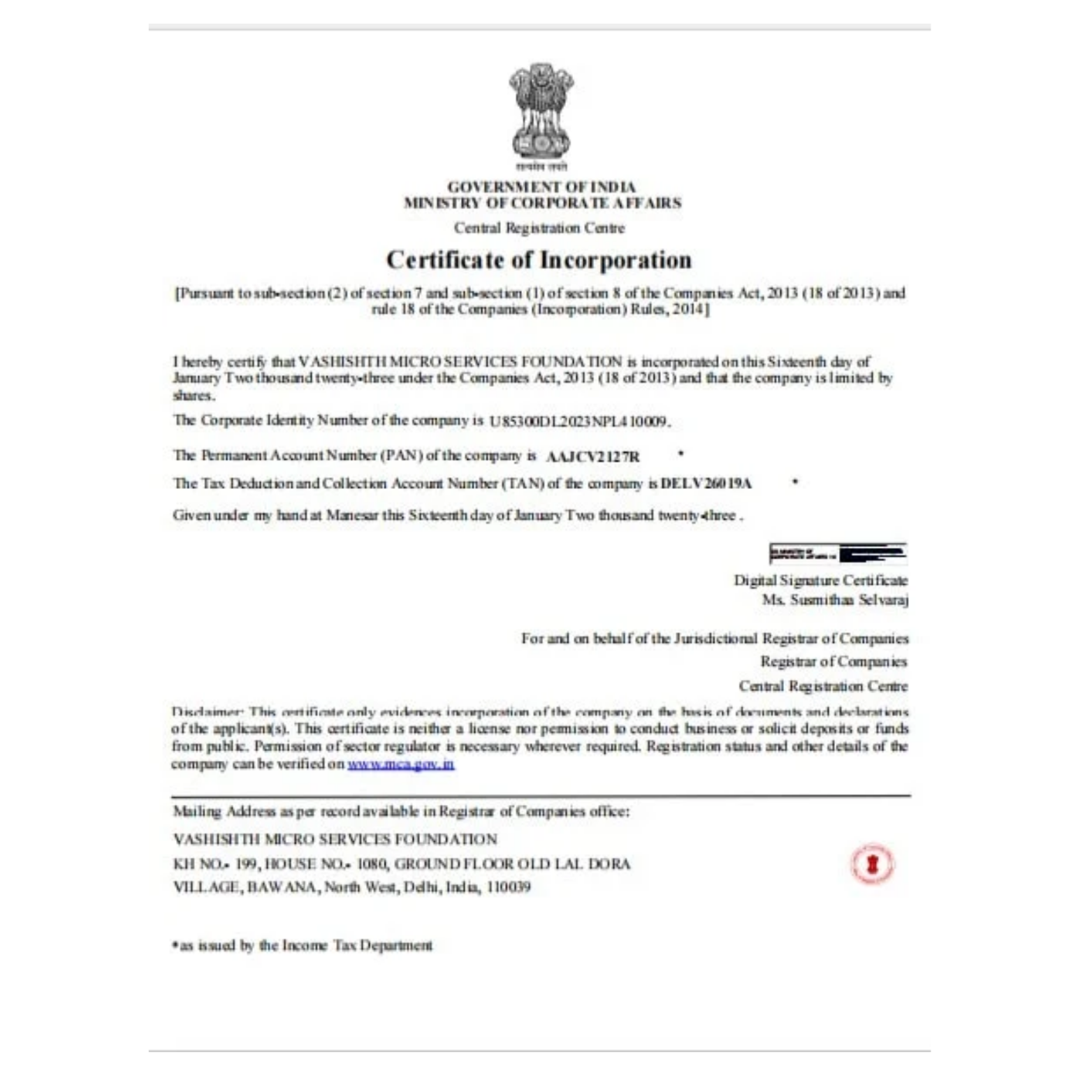

Documents & Details Required

of 2 persons

PAN, Aadhaar, Photo, Mobile, Email

PAN, Aadhaar, Photo, Mobile, Email Latest Bank Statements

Latest Bank Statements Company Name

Company Name Rent Agreement for the Company Address

Rent Agreement for the Company Address

Need Help?

Fill the Form Below