Annual Compliance for LLP: Key Requirements and Benefits

Annual Compliance for Limited Liability Partnerships (LLPs) must adhere to requirements to maintain legal standing, credibility, and financial transparency while avoiding significant penalties. LLPs are required to keep accurate financial records, file annual returns (Form 11), submit statements of accounts and solvency (Form 8), and complete income tax returns (ITR-5). Form 11, due by May 30, includes details of designated partners, contributions, and partner information. Form 8, due by October 30, outlines the LLP’s financial position and must be signed by designated partners and certified by a professional. A tax audit is mandatory for LLPs with a turnover above ₹40 lakhs or contributions exceeding ₹25 lakhs, with returns due by September 30. LLPs engaged in international or specified domestic transactions must file Form 3CEB by November 30. Non-compliance attracts a daily fine of ₹100, and failure to meet tax audit criteria can result in additional penalties.

10,000+

Clients Served

10,000+

Businesses Registered

10,000+

Legal Advices

Google Reviews

4.1/5 | 50+ Happy Reviews

Guaranteed Registration

Guaranteed Registration Cost Effective Rates

Cost Effective Rates 24x7 Support

24x7 Support 10K+ Businesses Registered

10K+ Businesses Registered

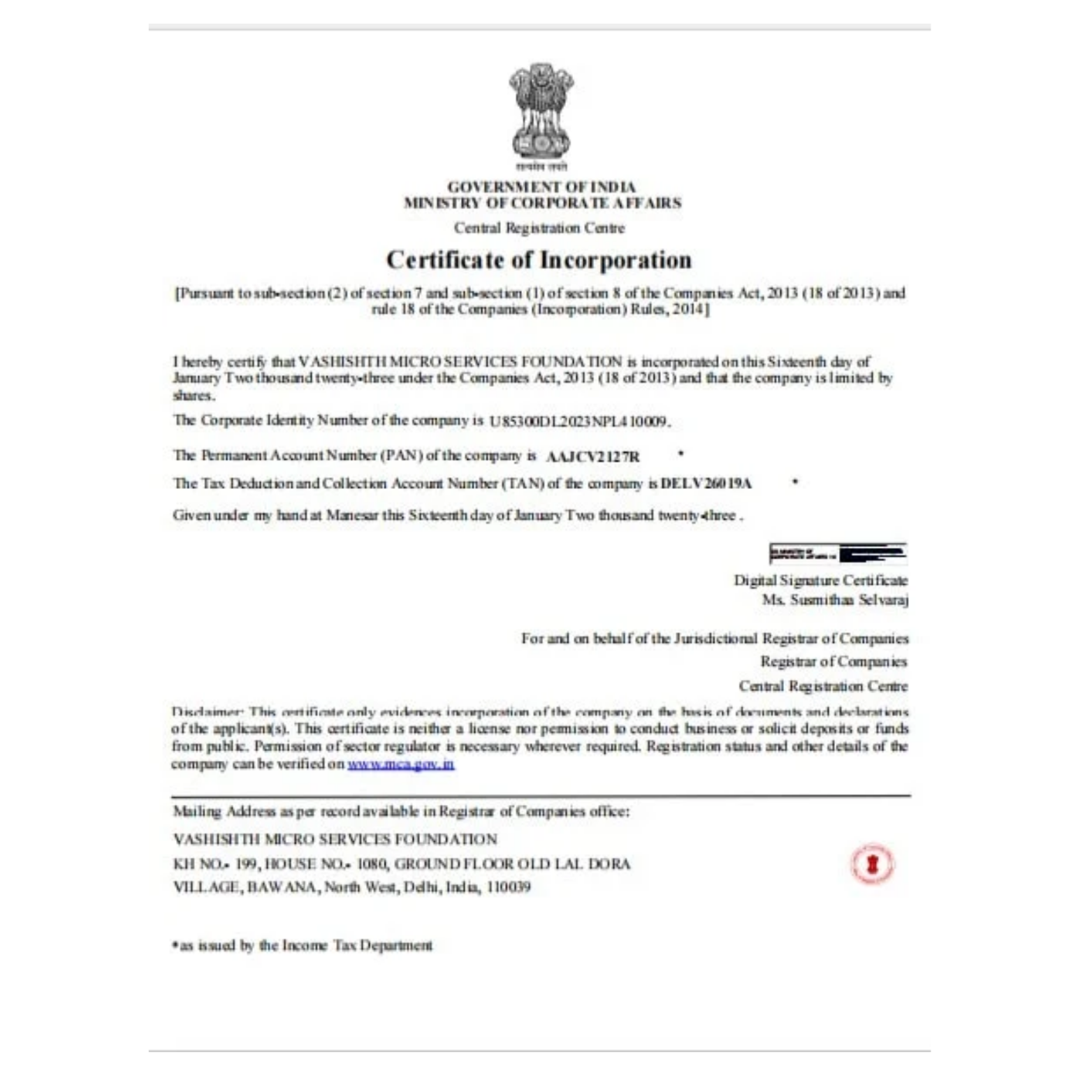

Documents & Details Required

of 2 persons

PAN, Aadhaar, Photo, Mobile, Email

PAN, Aadhaar, Photo, Mobile, Email Latest Bank Statements

Latest Bank Statements Company Name

Company Name Rent Agreement for the Company Address

Rent Agreement for the Company Address

Need Help?

Fill the Form Below