Annual Compliance of NBFCs: A Detailed Guide

Non-Banking Financial Companies (NBFCs) play a pivotal role in India's financial system, making annual compliance crucial to ensure smooth operations and adherence to regulatory standards. Governed by the Reserve Bank of India (RBI), NBFCs must comply with diverse requirements, including statutory audits, financial statement submissions, and RBI returns like NBS-7 and NBS-9, depending on their classification. Maintaining a minimum Net Owned Fund (NOF), adhering to capital adequacy norms (CAR of 15% or more), and provisioning for bad debts is essential for financial stability. Regular board meetings, AGMs, and detailed Director Reports highlight transparency and accountability. Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) norms ensures operational integrity. At the same time, corporate governance mandates for certain NBFCs emphasize appointing independent directors and forming committees. Tax compliance, including GST filings and TDS/TCS payments, adds to the obligations.

10,000+

Clients Served

10,000+

Businesses Registered

10,000+

Legal Advices

Google Reviews

4.1/5 | 50+ Happy Reviews

Guaranteed Registration

Guaranteed Registration Cost Effective Rates

Cost Effective Rates 24x7 Support

24x7 Support 10K+ Businesses Registered

10K+ Businesses Registered

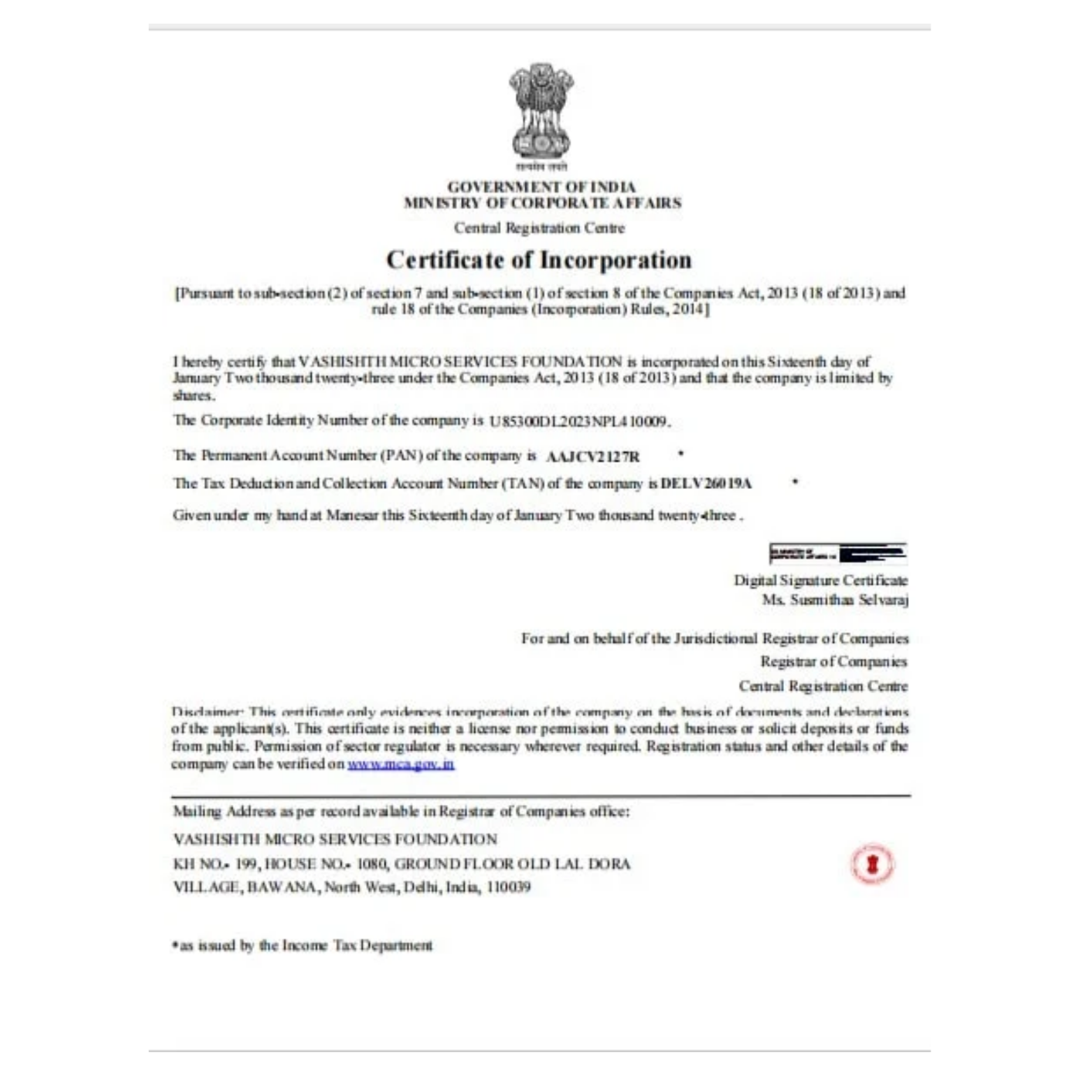

Documents & Details Required

of 2 persons

PAN, Aadhaar, Photo, Mobile, Email

PAN, Aadhaar, Photo, Mobile, Email Latest Bank Statements

Latest Bank Statements Company Name

Company Name Rent Agreement for the Company Address

Rent Agreement for the Company Address

Need Help?

Fill the Form Below