Convert Sole Proprietorship to Private Limited Company

Converting a sole proprietorship to a private limited company (Pvt Ltd) can offer significant advantages, including limited liability protection, increased credibility, better access to funding, and potential tax benefits. A sole proprietorship, while simple and flexible, exposes the owner to personal liability, whereas a private limited company limits shareholders' liabilities to their shareholding. The conversion process involves several steps: consulting with professionals for guidance, selecting a unique company name, preparing essential documents like the Memorandum and Articles of Association, registering the company with the Registrar of Companies, and transferring assets and liabilities from the sole proprietorship. Post-incorporation, the company must comply with regular legal requirements such as annual filings, board meetings, and tax filings. By making this transition, business owners can protect their personal assets, enhance business credibility, and position their companies for growth and scalability in a more structured corporate environment.

10,000+

Clients Served

10,000+

Businesses Registered

10,000+

Legal Advices

Google Reviews

4.1/5 | 50+ Happy Reviews

Guaranteed Registration

Guaranteed Registration Cost Effective Rates

Cost Effective Rates 24x7 Support

24x7 Support 10K+ Businesses Registered

10K+ Businesses Registered

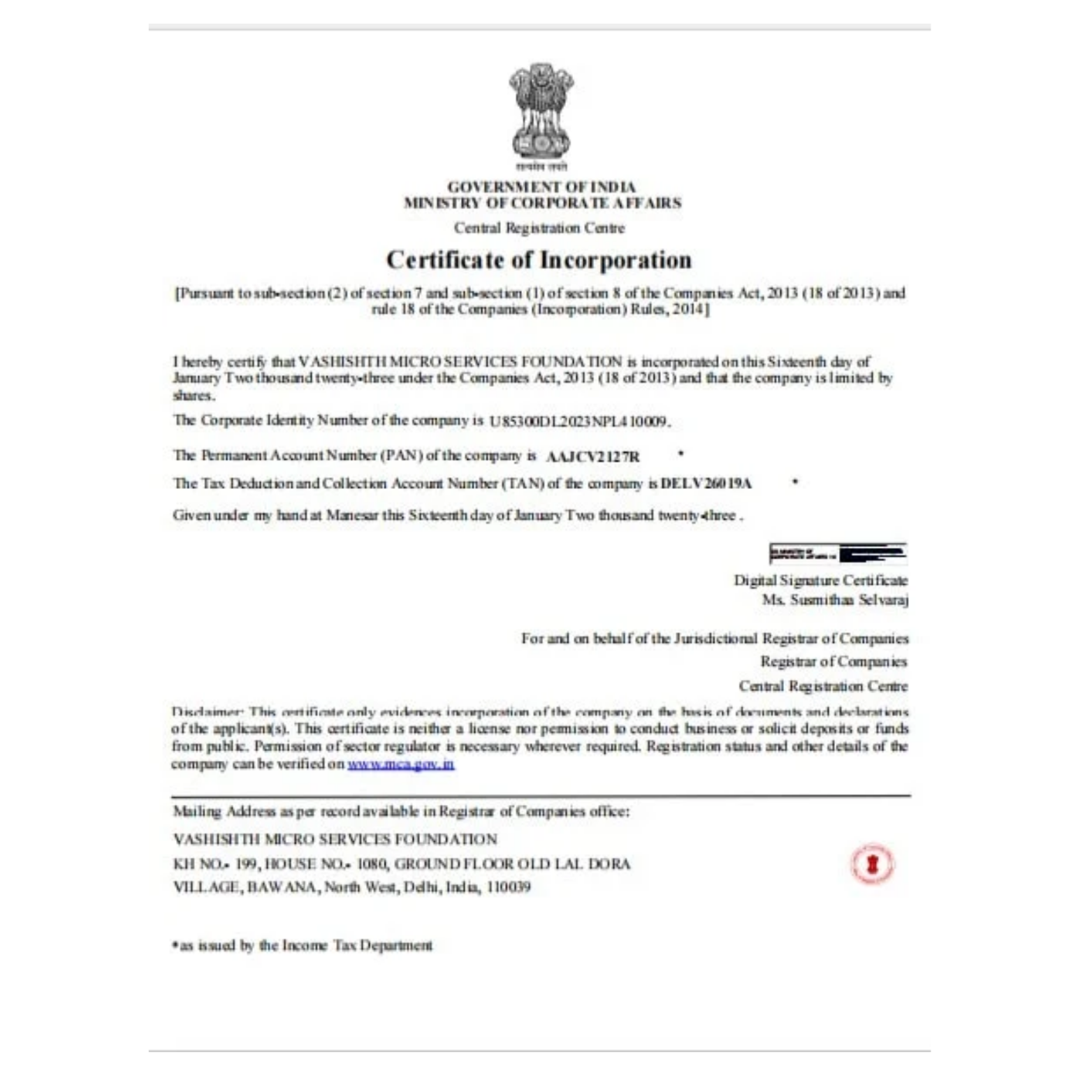

Documents & Details Required

of 2 persons

PAN, Aadhaar, Photo, Mobile, Email

PAN, Aadhaar, Photo, Mobile, Email Latest Bank Statements

Latest Bank Statements Company Name

Company Name Rent Agreement for the Company Address

Rent Agreement for the Company Address

Need Help?

Fill the Form Below