Understanding EPF Returns: A Comprehensive Guide

The Employee Provident Fund (EPF) is a vital retirement savings scheme in India, where both employees and employers contribute a percentage of the salary. The employee contributes 12% of their basic salary, with the employer matching this amount. The EPF balance grows with annual interest, compounded each year, and the returns are tax-free if the employee remains in service for at least five years. Factors like interest rate changes, salary growth, and consistent contributions affect the returns. EPF is a low-risk, government-backed investment that offers stability, though its returns may be lower compared to market-linked options. Despite this, its tax benefits and compounded growth make it a valuable tool for retirement planning, ensuring financial security after retirement.

10,000+

Clients Served

10,000+

Businesses Registered

10,000+

Legal Advices

Google Reviews

4.1/5 | 50+ Happy Reviews

Guaranteed Registration

Guaranteed Registration Cost Effective Rates

Cost Effective Rates 24x7 Support

24x7 Support 10K+ Businesses Registered

10K+ Businesses Registered

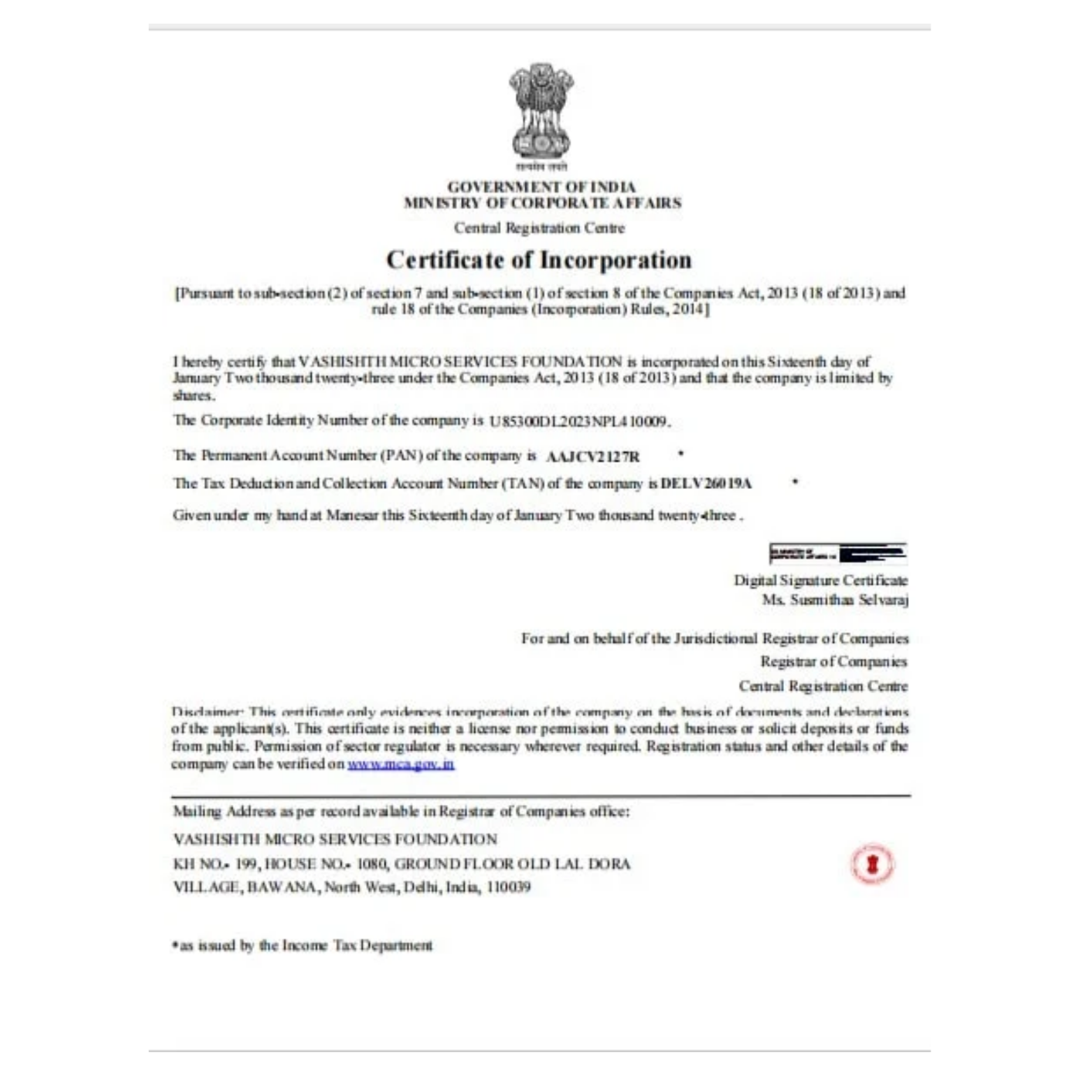

Documents & Details Required

of 2 persons

PAN, Aadhaar, Photo, Mobile, Email

PAN, Aadhaar, Photo, Mobile, Email Latest Bank Statements

Latest Bank Statements Company Name

Company Name Rent Agreement for the Company Address

Rent Agreement for the Company Address

Need Help?

Fill the Form Below