Understanding Form 15CA and 15CB for Tax Compliance

Form 15CA and 15CB are essential for tax compliance when making payments to non-residents in India. Form 15CA is a declaration by the payer, confirming taxes are paid or not applicable under the Income Tax Act. Form 15CB is a certificate from a Chartered Accountant, verifying the payment complies with tax regulations. Both forms are required for certain payments like royalties or technical fees and must be submitted before the payment. Form 15CA is filed online, while Form 15CB requires a physical signature. These forms help ensure tax transparency in cross-border transactions and avoid penalties.

10,000+

Clients Served

10,000+

Businesses Registered

10,000+

Legal Advices

Google Reviews

4.1/5 | 50+ Happy Reviews

Guaranteed Registration

Guaranteed Registration Cost Effective Rates

Cost Effective Rates 24x7 Support

24x7 Support 10K+ Businesses Registered

10K+ Businesses Registered

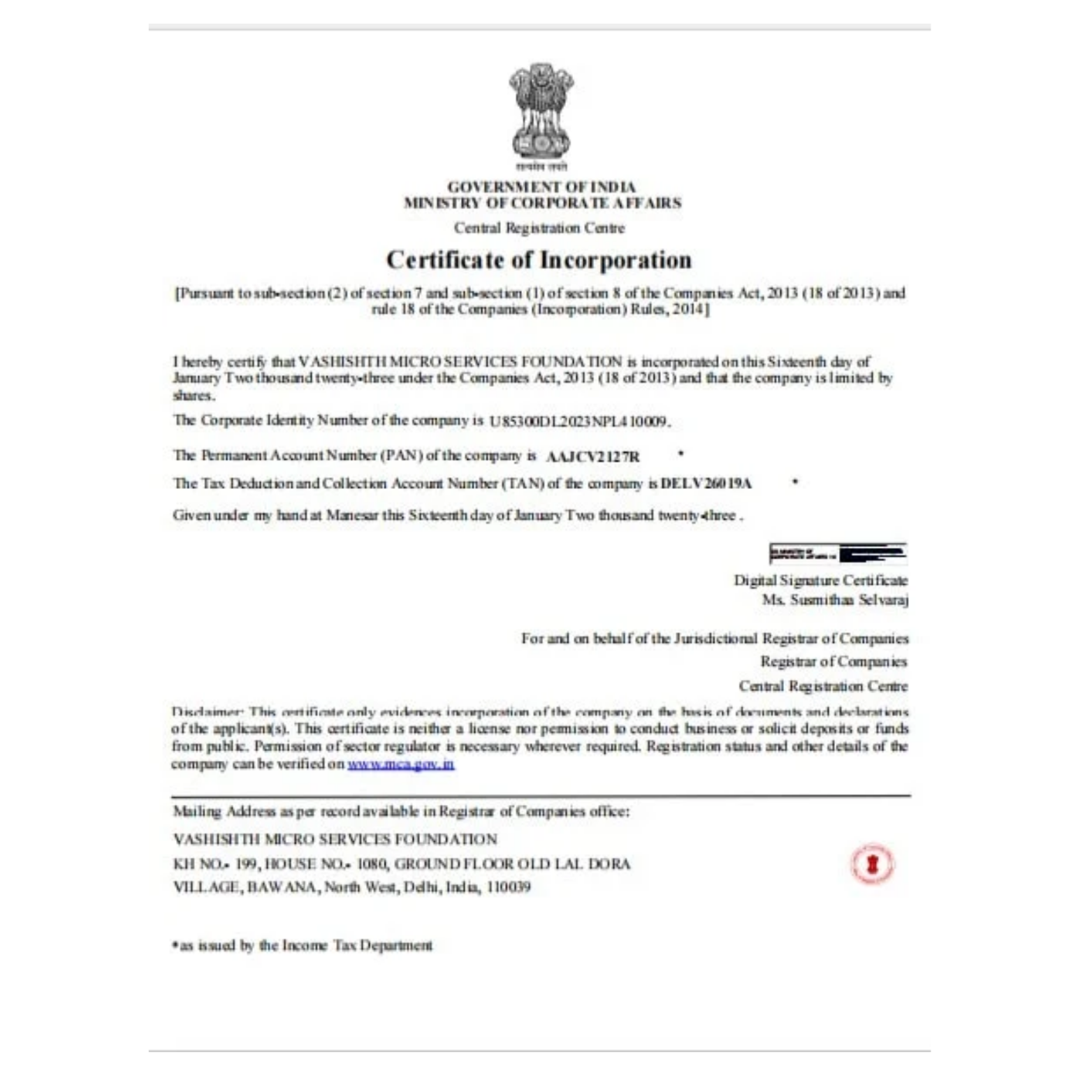

Documents & Details Required

of 2 persons

PAN, Aadhaar, Photo, Mobile, Email

PAN, Aadhaar, Photo, Mobile, Email Latest Bank Statements

Latest Bank Statements Company Name

Company Name Rent Agreement for the Company Address

Rent Agreement for the Company Address

Need Help?

Fill the Form Below