Reinstate Cancelled GST Registration Easily

GST revocation is the process of reinstating a taxpayer’s Goods and Services Tax (GST) registration that was canceled either voluntarily or by tax authorities due to reasons like non-compliance or business closure. Under Rule 23 of the Central Goods and Services Tax Rules, 2017, taxpayers can apply for revocation by filing Form GST REG-21 through the GST portal and submitting supporting documents and reasons for the request. Upon approval, authorities issue a revocation order to restore the GST Identification Number (GSTIN).

10,000+

Clients Served

10,000+

Businesses Registered

10,000+

Legal Advices

Google Reviews

4.1/5 | 50+ Happy Reviews

Guaranteed Registration

Guaranteed Registration Cost Effective Rates

Cost Effective Rates 24x7 Support

24x7 Support 10K+ Businesses Registered

10K+ Businesses Registered

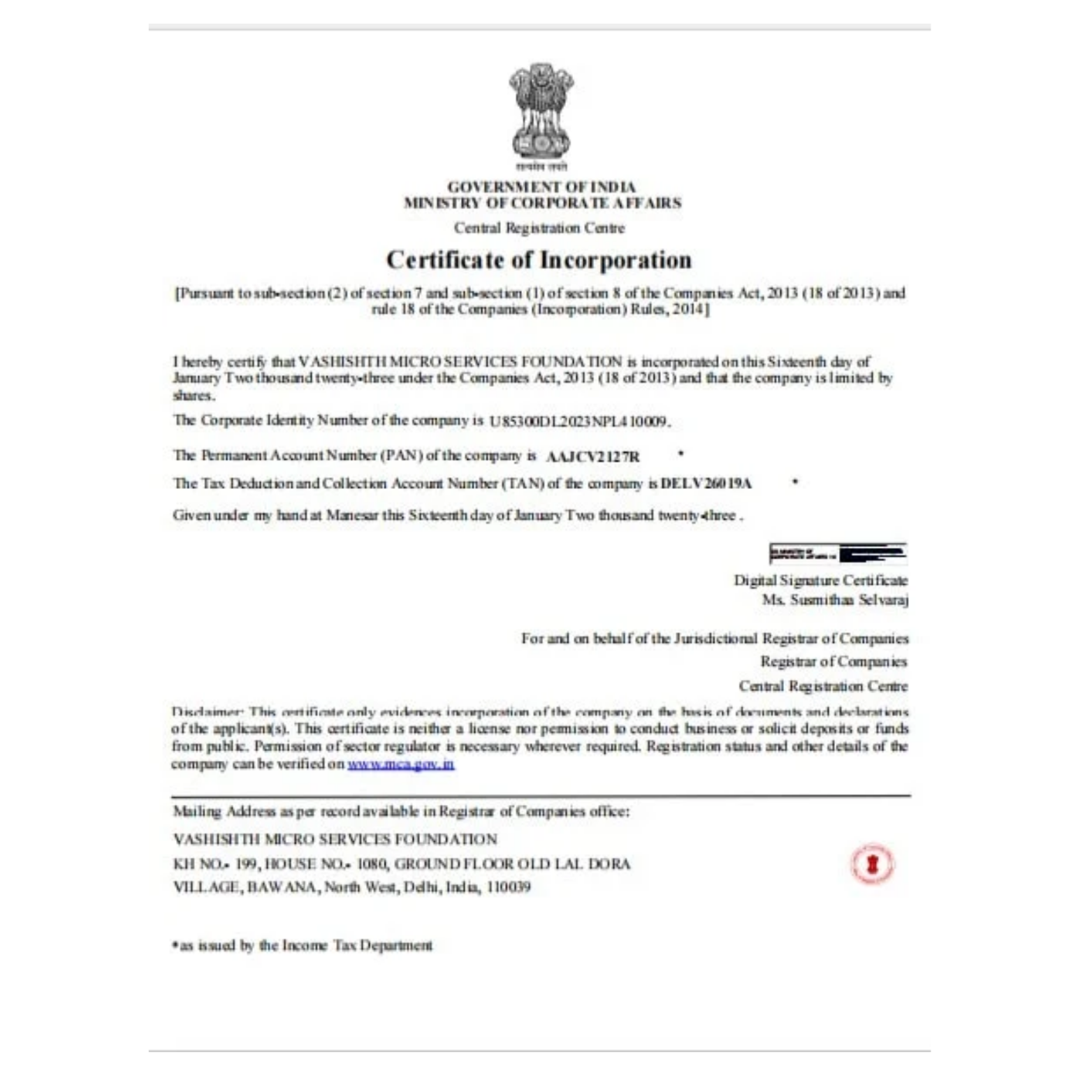

Documents & Details Required

of 2 persons

PAN, Aadhaar, Photo, Mobile, Email

PAN, Aadhaar, Photo, Mobile, Email Latest Bank Statements

Latest Bank Statements Company Name

Company Name Rent Agreement for the Company Address

Rent Agreement for the Company Address

Need Help?

Fill the Form Below