ITR-4 Return Filing: Simplified Guide for Presumptive Taxation

The ITR-4 Form also known as the Sugam form, is designed for individuals, Hindu Undivided Families (HUFs), and firms (excluding LLPs) who opt for the presumptive taxation scheme under Sections 44AD, 44ADA, and 44AE of the Income Tax Act. This form simplifies tax filing by allowing taxpayers to declare their income on a presumptive basis, eliminating the need for maintaining detailed financial records. It applies to those with a total income up to Rs. 50 lakhs, derived from salary, pension, business (with turnover up to Rs. 2 crore), or professional income (up to Rs. 50 lakh). The form is structured into sections for personal details, gross income, deductions, and tax computation. However, it is not suitable for directors of companies, individuals with foreign assets or income, or those with income from capital gains, speculative business, or multiple houses. Filing the ITR-4 is straightforward via the Income Tax Department’s e-filing portal, ensuring a simplified process for eligible taxpayers to comply with tax regulations.

10,000+

Clients Served

10,000+

Businesses Registered

10,000+

Legal Advices

Google Reviews

4.1/5 | 50+ Happy Reviews

Guaranteed Registration

Guaranteed Registration Cost Effective Rates

Cost Effective Rates 24x7 Support

24x7 Support 10K+ Businesses Registered

10K+ Businesses Registered

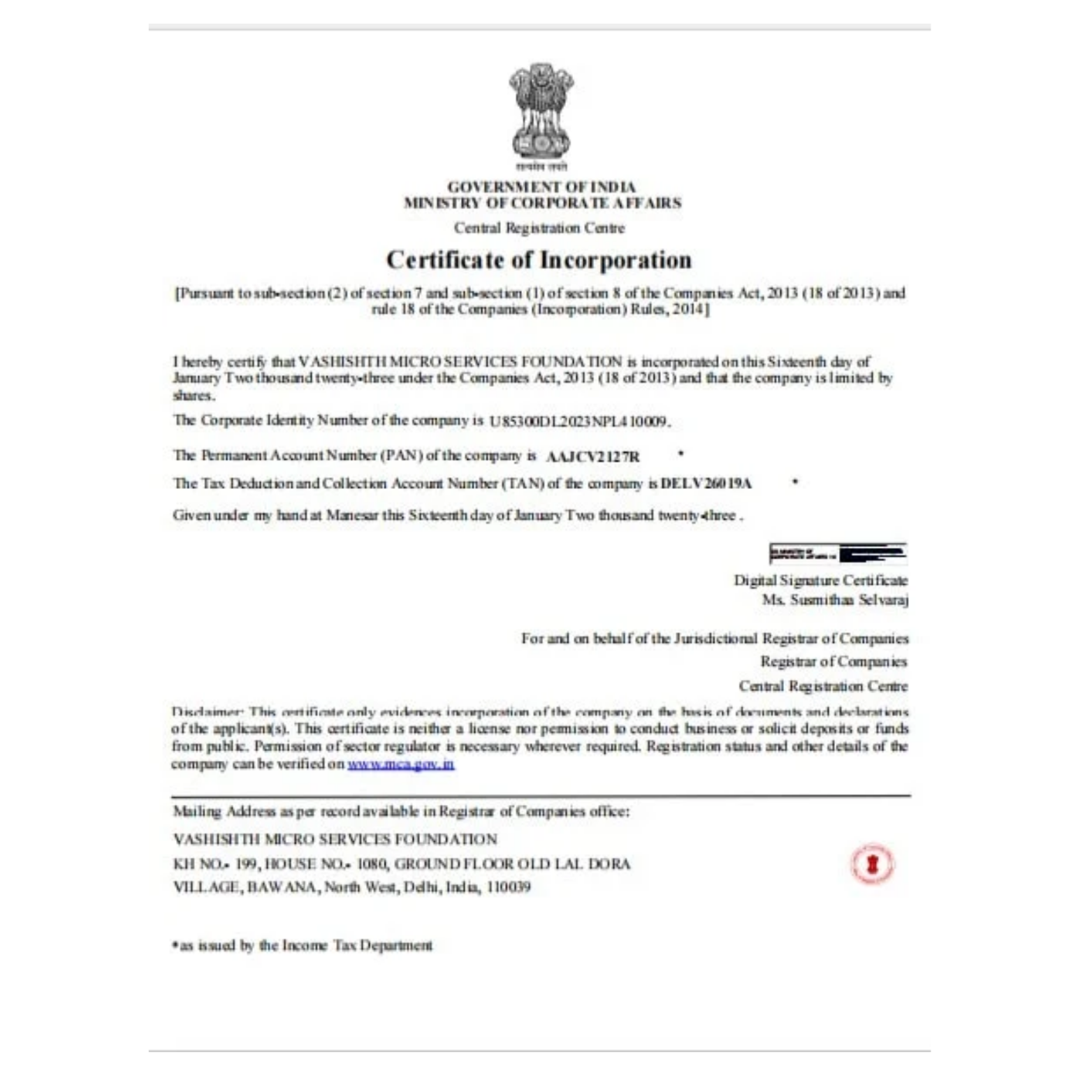

Documents & Details Required

of 2 persons

PAN, Aadhaar, Photo, Mobile, Email

PAN, Aadhaar, Photo, Mobile, Email Latest Bank Statements

Latest Bank Statements Company Name

Company Name Rent Agreement for the Company Address

Rent Agreement for the Company Address

Need Help?

Fill the Form Below