ITR-6 Filing Guide for Companies in India: Steps, Requirements and Benefits

Filing ITR-6 is a crucial compliance task for companies in India, as it ensures adherence to the Income Tax Act 1961. Companies registered under the Companies Act, 2013 or 1956 must file ITR-6, excluding those claiming an exemption under Section 11 of the Act, which applies to charitable or religious organizations. ITR-6 is designed to report income, claim deductions, and calculate tax liabilities for private limited companies, public limited companies, and one-person companies (OPCs). Filing on time is important to avoid penalties under Section 234F and interest charges under Sections 234A, 234B, and 234C for delayed submissions. Additionally, timely filing ensures the company’s ability to carry forward losses for up to 8 years, which can reduce tax liabilities in future years. Companies that file on time are also less likely to face scrutiny from tax authorities, reducing the risk of audits and potential disruptions to business operations.

10,000+

Clients Served

10,000+

Businesses Registered

10,000+

Legal Advices

Google Reviews

4.1/5 | 50+ Happy Reviews

Guaranteed Registration

Guaranteed Registration Cost Effective Rates

Cost Effective Rates 24x7 Support

24x7 Support 10K+ Businesses Registered

10K+ Businesses Registered

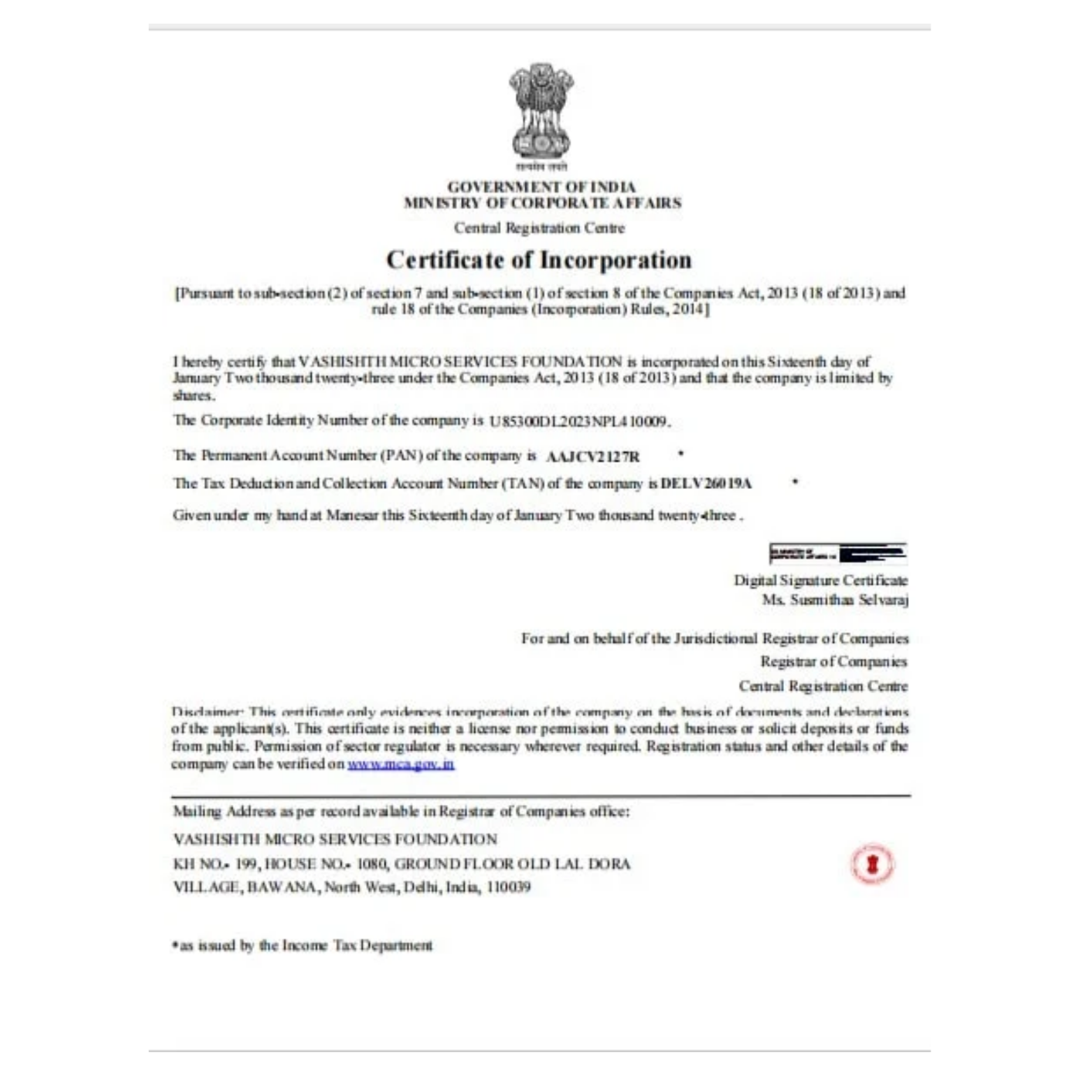

Documents & Details Required

of 2 persons

PAN, Aadhaar, Photo, Mobile, Email

PAN, Aadhaar, Photo, Mobile, Email Latest Bank Statements

Latest Bank Statements Company Name

Company Name Rent Agreement for the Company Address

Rent Agreement for the Company Address

Need Help?

Fill the Form Below