Easy Guide to Professional Tax Registration in India

Professional tax registration is a crucial process for individuals and businesses in India who earn their livelihood through employment, profession, or trade. This tax, levied by state governments, ensures that those earning an income contribute to the state’s revenue, which is used for local development and infrastructure. The tax applies to a wide range of individuals, including salaried employees, freelancers, professionals (such as doctors, lawyers, and consultants), business owners, and even corporations. The amount of professional tax varies from state to state, with each state having its own rules, tax slabs, exemptions, and payment procedures. For example, the tax rates in Maharashtra differ from those in Tamil Nadu or West Bengal, with some states offering exemptions for low-income earners or senior citizens. The registration process for professional tax typically involves determining whether an individual or business is liable to pay the tax, gathering the necessary documents like proof of identity, income details, and business registration certificates, and submitting an application to the respective state government’s professional tax office.

10,000+

Clients Served

10,000+

Businesses Registered

10,000+

Legal Advices

Google Reviews

4.1/5 | 50+ Happy Reviews

Guaranteed Registration

Guaranteed Registration Cost Effective Rates

Cost Effective Rates 24x7 Support

24x7 Support 10K+ Businesses Registered

10K+ Businesses Registered

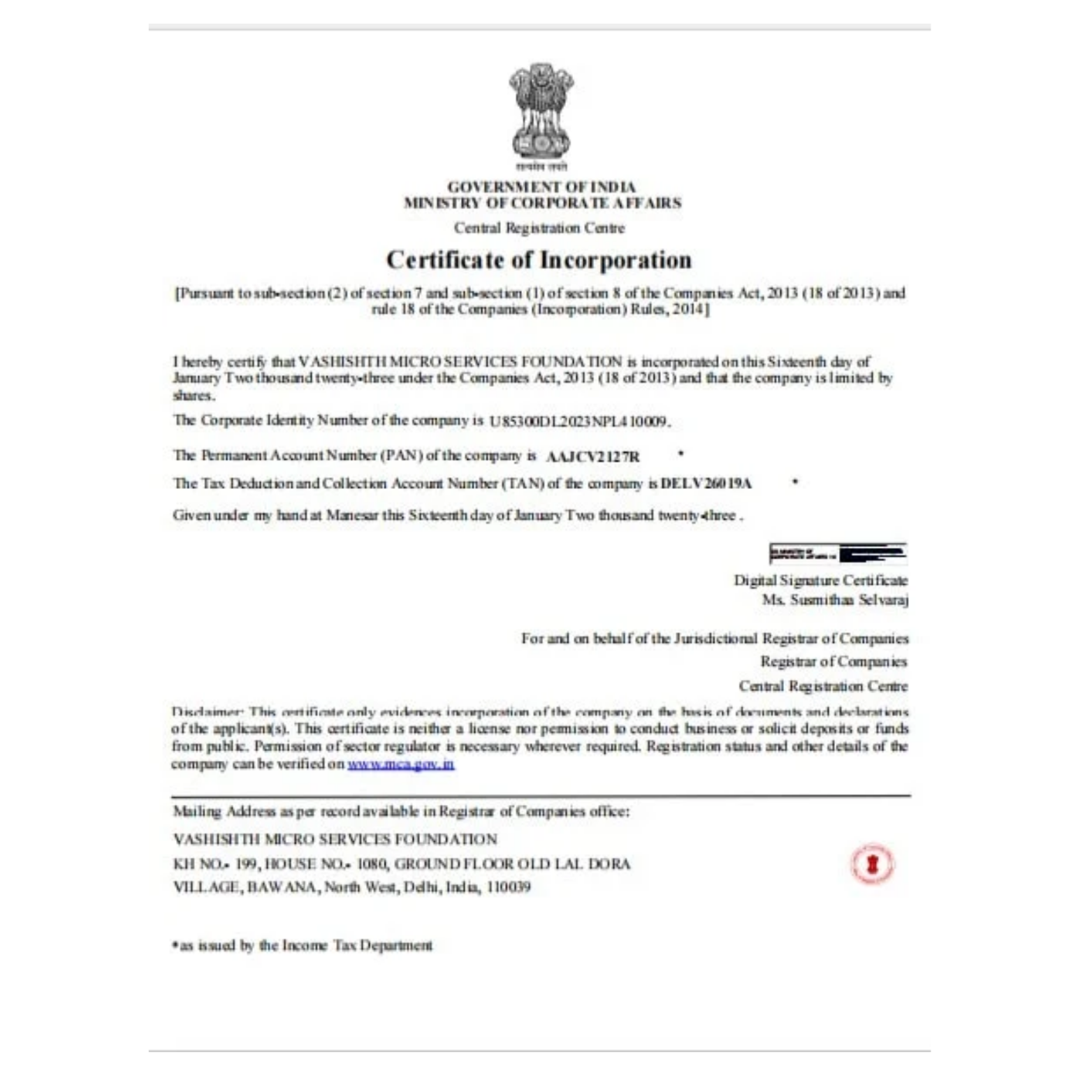

Documents & Details Required

of 2 persons

PAN, Aadhaar, Photo, Mobile, Email

PAN, Aadhaar, Photo, Mobile, Email Latest Bank Statements

Latest Bank Statements Company Name

Company Name Rent Agreement for the Company Address

Rent Agreement for the Company Address

Need Help?

Fill the Form Below