Annual Compliance for Sole Proprietorship

Annual compliance for sole proprietorships in India is essential to ensure smooth operations and avoid legal penalties. A sole proprietorship, being one of the simplest forms of business, still requires adherence to various tax, regulatory, and licensing requirements. Income tax compliance involves filing annual returns by 31st July or 30th September (if audited) and paying advance tax if the liability exceeds ₹10,000. Tax audits are mandatory for turnovers exceeding ₹1 crore. GST compliance is required for businesses with turnovers above ₹40 lakh (₹20 lakh for special category states), involving filing returns like GSTR-1, GSTR-3B, and GSTR-9. E-invoicing is mandatory for businesses exceeding ₹10 crore turnover. Proper maintenance of books of accounts, including invoices, expense records, and bank statements, is crucial for at least six years.

10,000+

Clients Served

10,000+

Businesses Registered

10,000+

Legal Advices

Google Reviews

4.1/5 | 50+ Happy Reviews

Guaranteed Registration

Guaranteed Registration Cost Effective Rates

Cost Effective Rates 24x7 Support

24x7 Support 10K+ Businesses Registered

10K+ Businesses Registered

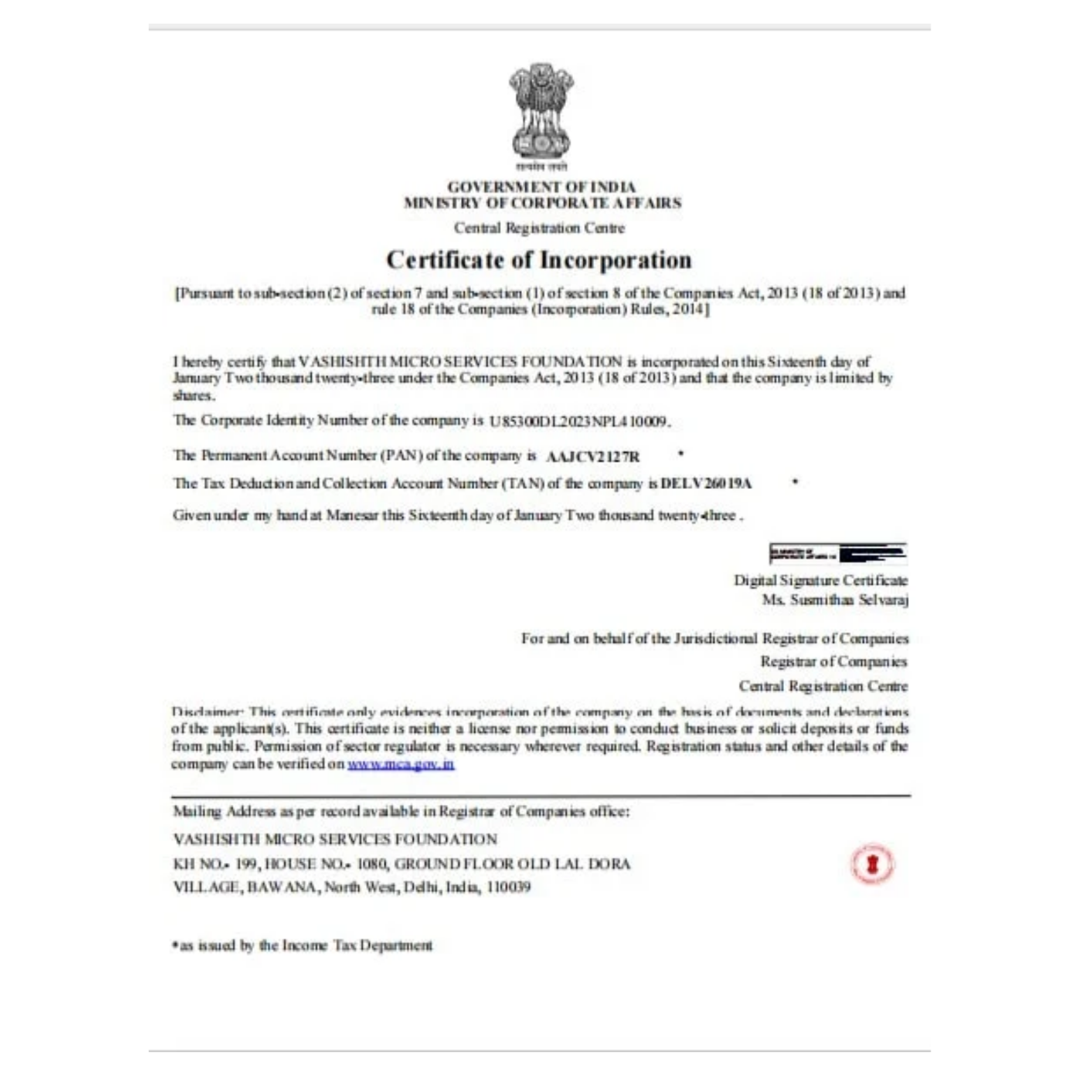

Documents & Details Required

of 2 persons

PAN, Aadhaar, Photo, Mobile, Email

PAN, Aadhaar, Photo, Mobile, Email Latest Bank Statements

Latest Bank Statements Company Name

Company Name Rent Agreement for the Company Address

Rent Agreement for the Company Address

Need Help?

Fill the Form Below