TAN Registration: Obtaining Tax Deduction Account Number

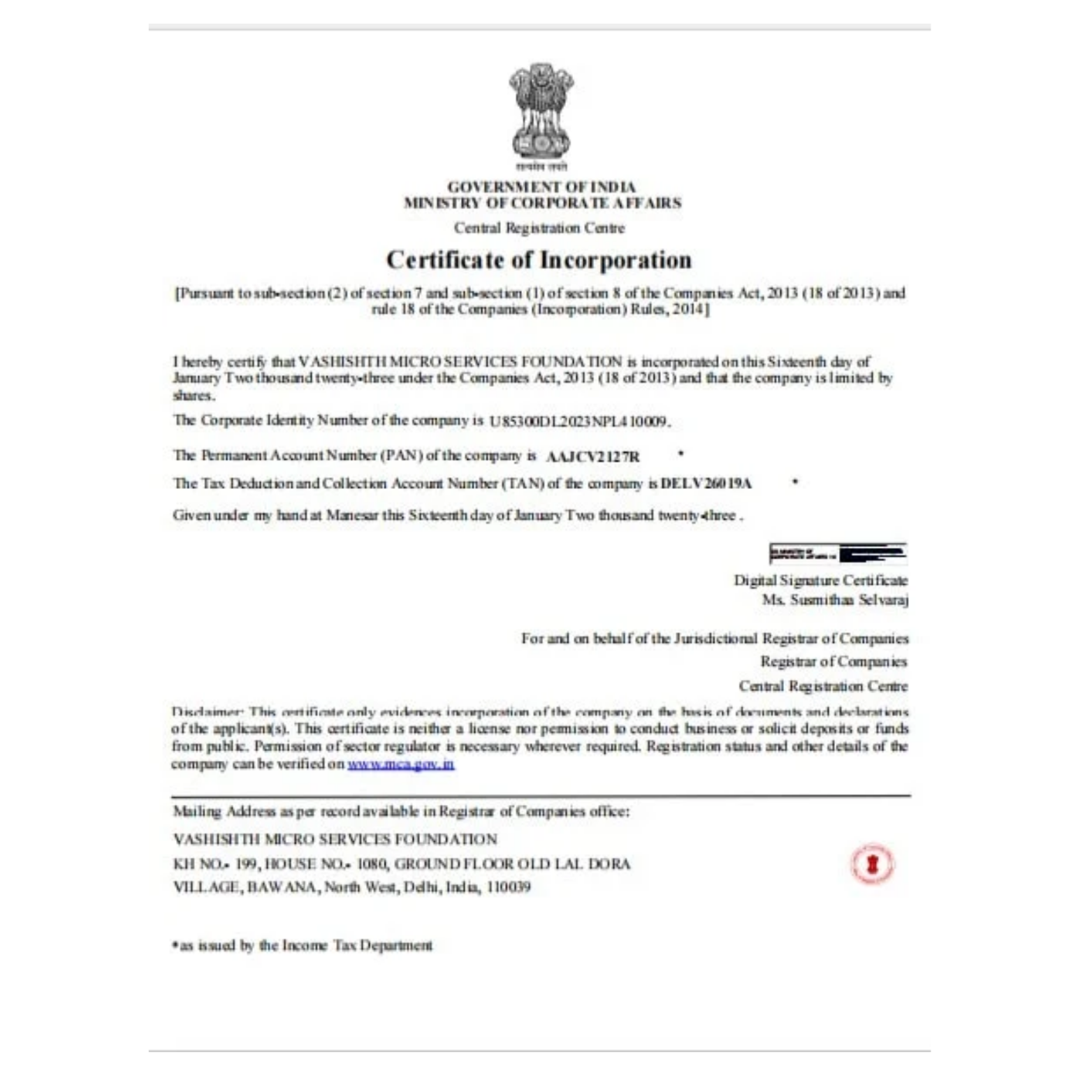

TAN registration in India is mandatory for individuals or entities involved in tax deduction or collection activities (TDS/TCS). The Tax Deduction and Collection Account Number (TAN) is a 10-digit alphanumeric identifier issued by the Income Tax Department, essential for businesses, non-profits, and sole proprietors who deduct tax at source for payments like salaries or contractor fees. Non-compliance can lead to penalties. TAN registration is required for legal compliance, and it helps track and reconcile tax deductions. The registration process can be completed online through the NSDL website or offline at a TIN Facilitation Center. The TAN must be quoted in all TDS/TCS returns and challans to ensure proper tax submission. Once issued, TAN is valid for a lifetime and simplifies tax operations, preventing errors and ensuring adherence to tax laws.

10,000+

Clients Served

10,000+

Businesses Registered

10,000+

Legal Advices

Google Reviews

4.1/5 | 50+ Happy Reviews

Guaranteed Registration

Guaranteed Registration Cost Effective Rates

Cost Effective Rates 24x7 Support

24x7 Support 10K+ Businesses Registered

10K+ Businesses Registered

Documents & Details Required

of 2 persons

PAN, Aadhaar, Photo, Mobile, Email

PAN, Aadhaar, Photo, Mobile, Email Latest Bank Statements

Latest Bank Statements Company Name

Company Name Rent Agreement for the Company Address

Rent Agreement for the Company Address

Need Help?

Fill the Form Below